Kyowa Kirin

May 31, 2024

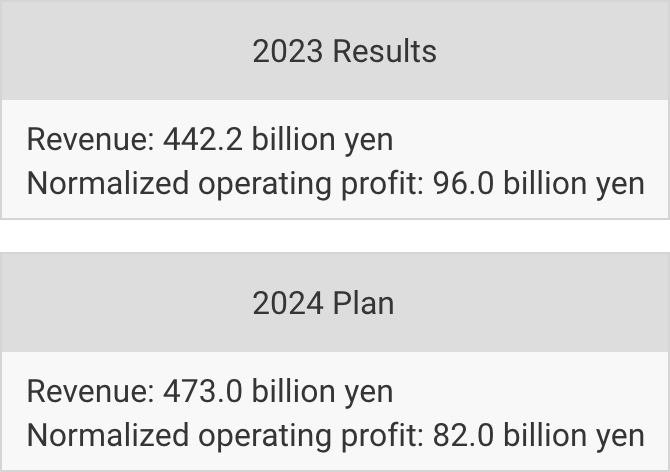

2023 Review

- Promoted growth initiatives as a Japanese Global Specialty Pharmaceutical Company from Japan.

- Global strategy products continue to grow steadily, and secured more earnings due to the favorable increase in sales, mainly of Crysvita, which was launched in North America, and more.

- In regard to the development pipeline, despite the suspended development of RTA 402 and other products, the development of KHK4083 / AMG 451 (rocatinlimab) and more progressed well. On top of that, in order to strengthen capabilities of creating new medicines in the future, concluded a contract to acquire Orchard Therapeutics, who established a necessary business platform with products and developments using hematopoietic stem cell gene therapy.

2024 Plan

- Further grow toward maximizing the value of the global strategy products Crysvita and Poteligeo by leveraging evidence gathered through past activities, enhancing disease awareness activities focused on target patients, and through other efforts.

- Additionally, strengthen strategic R&D investments and steadily promote the global development of KHK4083 / AMG 451 (rocatinlimab) and other products to expand the development pipeline, while promoting PMI (post-merger integration) with Orchard Therapeutics, acquired in January, in aim of new value creation.

- Increase revenue through the further growth of global strategic products, including Cyrsvita. Meanwhile, profit is expected to decrease due to an increase in R&D expenses due to the acquisition of Orchard Therapeutics and phase 3 development (ROCKET Program) of KHK4083 / AMG 451 (rocatinlimab).

Example

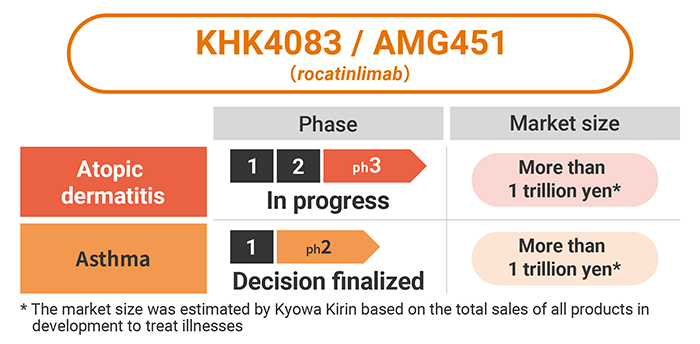

Steady progression of clinical trials for KHK4083 / AMG451

Clinical trials for KHK4083 / AMG 451 (rocatinlimab), which is expected to be another growth pillar in addition to Crysvita, as a treatment for atopic dermatitis are progressing smoothly and we also plan to test its effectiveness on asthma.

The scale of the atopic dermatitis market and the asthma market we are considering developing are estimated to be worth more than 1 trillion yen.

Each of these markets has a lot of competition, but if we are able to secure certain market shares of a unique medicine that takes advantage of our collaboration with Amgen, we expect KHK4083 / AMG 451 (rocatinlimab) will be a major pillar of revenue for Kyowa Kirin.